The landscape of international banking is undergoing a significant transformation, driven by advancements in digital banking and fintech. Increasingly, foreign nationals and expats are seeking avenues for remote account opening with financial institutions globally. This article provides a detailed examination of acquiring online bank accounts as a non-resident, encompassing account eligibility, procedural requirements, and associated considerations.

The Rise of Digital Accessibility in International Finance

Traditionally, establishing a banking relationship in a foreign jurisdiction necessitated physical presence. However, the proliferation of online banking and virtual banking platforms has democratized access to financial services, fostering greater financial inclusion. This shift is particularly beneficial for individuals engaged in cross-border banking, offshore banking (where legally permissible), and those requiring non-resident accounts. The convenience of online applications and streamlined processes are key drivers of this trend.

Account Eligibility and Documentation Requirements

Account eligibility criteria vary significantly between financial institutions and jurisdictions. Generally, applicants must demonstrate legal residency status in their country of origin, even when applying for a non-resident account. Residency requirements are often less stringent for online applications than in-branch openings. However, rigorous adherence to KYC compliance (Know Your Customer) and AML regulations (Anti-Money Laundering) is paramount.

Typical documentation requirements include:

- Identity verification: Passport, national ID card, or driver’s license. Increasingly, digital identity solutions are being accepted.

- Proof of address: Utility bill, bank statement (from existing account), or official government correspondence.

- Proof of income/funds: Employment contract, tax returns, or investment statements.

- Source of wealth declaration: Required to satisfy AML scrutiny.

Navigating the Application Process & Associated Costs

The online application process typically involves completing a digital form, uploading required documentation, and undergoing a verification process. Some institutions may require a video interview. Bank transfers and international wire transfers are standard functionalities, often with associated fees. Currency exchange rates and fees should be carefully evaluated.

Potential costs to consider:

- Account fees: Monthly maintenance fees, transaction fees, or inactivity fees.

- Minimum balance requirements: Some accounts necessitate maintaining a specified minimum balance.

- International wire transfer fees: Vary depending on the amount and destination.

- Currency exchange rate markups: Banks typically add a markup to the interbank exchange rate.

Security Considerations and Regulatory Compliance

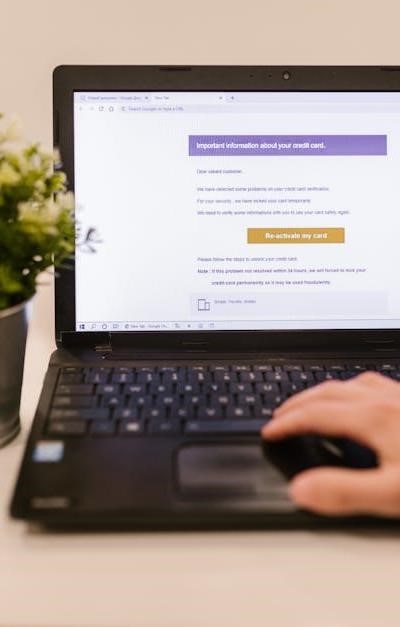

Secure banking is of utmost importance. Reputable financial institutions employ robust online security measures, including encryption, two-factor authentication, and fraud detection systems. It is crucial to understand the banking regulations of the jurisdiction in which the bank is located.

Digital finance is heavily regulated, and banks are obligated to comply with international standards regarding data privacy and financial transparency. Choosing a well-established and regulated institution is paramount to mitigating risk;

Global Access and Future Trends

The ability to access financial services remotely offers unparalleled global access. As fintech continues to innovate, we can anticipate further streamlining of the remote account opening process, increased acceptance of digital identity solutions, and enhanced online security protocols. The future of offshore banking and international banking is undeniably digital.

This article presents a comprehensive and meticulously researched overview of the evolving landscape of international banking for non-residents. The delineation between traditional banking constraints and the advantages afforded by digital accessibility is particularly insightful. The emphasis on KYC and AML compliance is not merely procedural, but rather a crucial acknowledgement of the regulatory environment governing cross-border financial transactions. A highly valuable resource for both individuals and professionals navigating this complex domain.

A well-structured and informative piece. The author accurately identifies the key drivers behind the increasing demand for remote bank account opening, namely the advancements in fintech and the need for greater financial inclusion. The detailed breakdown of documentation requirements is exceptionally practical, and the acknowledgement of the growing acceptance of digital identity solutions demonstrates a forward-thinking perspective. The article successfully balances accessibility with the necessary caveats regarding legal and regulatory adherence.